WooCommerce EU VAT Number

Collect and validate EU VAT numbers on WooCommerce checkout. Automatically exempt VAT for valid numbers. Add all EU countries VAT standard rates to WooCommerce

Description

When enabled, WooCommerce EU VAT Number module lets you collect and validate EU VAT numbers on WooCommerce checkout and automatically (if necessary) exempt VAT for valid numbers. You can also add predefined set of 28 European Union countries standard VAT rates to WooCommerce.

Collecting and Validating EU VAT Numbers

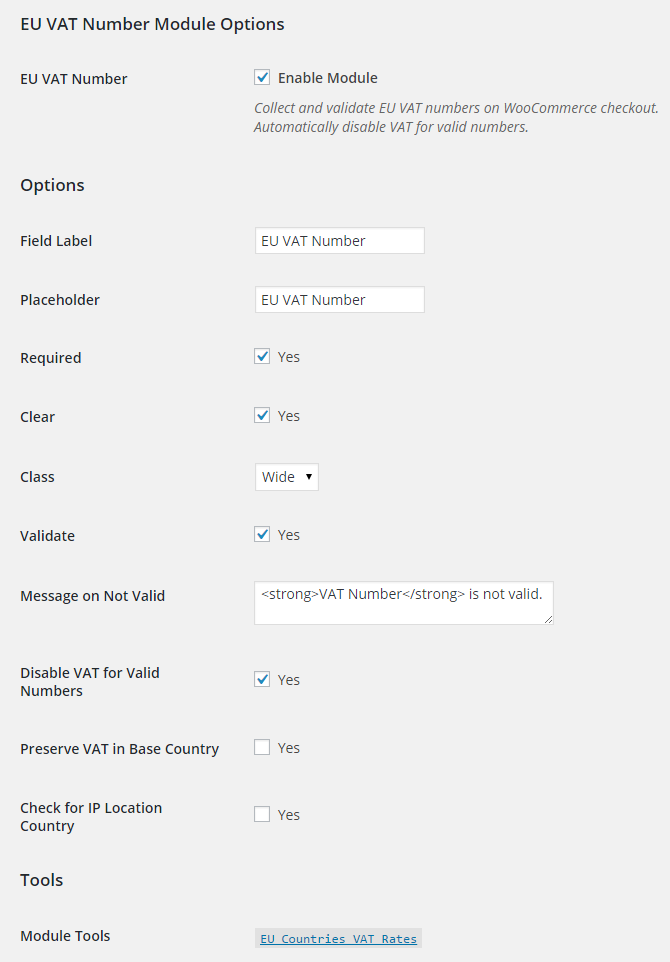

You should start by visiting module’s settings at WooCommerce > Settings > Booster > Emails & Misc. > EU VAT Number

- Field Label

- Field label on shop’s checkout (frontend).

- Default:

EU VAT Number

- Default:

- Placeholder

- Field placeholder on shop’s checkout.

- Default:

EU VAT Number

- Default:

- Required

- Should the field be required for customer to fill on checkout?

- Default:

No

- Default:

- Clear

- CSS clear after the field.

- Default:

Yes

- Default:

- Class

- CSS class.

- Default:

Wide

- Default:

- Validate

- Should the VAT be validated? VAT is validated through “VAT Information Exchange System (VIES)”.

- Default:

Yes

- Default:

- Message on Not Valid

- Message to the customer if VAT is not valid.

- Default:

EU VAT Number is not valid.

- Default:

- Disable VAT for Valid Numbers

- Subtract VAT from order for validated numbers.

- Default:

Yes

- Default:

- Preserve VAT in Base Country

- This will prevent from subtracting the VAT for validated customers with billing country same as shop’s base country.

- Default:

No

- Default:

- Check for IP Location Country

- Allow only customers located in country to enter that country’s VAT code. Customer is located by IP.

- Default:

No

- Default:

Adding customer’s EU VAT Number to PDF Invoices

This can be done with wcj_order_checkout_field shortcode

EU Countries VAT Rates Tool

List of EU VAT rates to be added

| Country | Rate | |

|---|---|---|

| AT – Austria | 20% | |

| BE – Belgium | 21% | |

| BG – Bulgaria | 20% | |

| CY – Cyprus | 19% | |

| CZ – Czech Republic | 21% | |

| DE – Germany | 19% | |

| DK – Denmark | 25% | |

| EE – Estonia | 20% | |

| ES – Spain | 21% | |

| 10 | FI – Finland | 24% |

| 11 | FR – France | 20% |

| 12 | GB – United Kingdom (UK) | 20% |

| 13 | GR – Greece | 23% |

| 14 | HU – Hungary | 27% |

| 15 | HR – Croatia | 25% |

| 16 | IE – Republic of Ireland | 23% |

| 17 | IT – Italy | 22% |

| 18 | LT – Lithuania | 21% |

| 19 | LU – Luxembourg | 17% |

| 20 | LV – Latvia | 21% |

| 21 | MT – Malta | 18% |

| 22 | NL – Netherlands | 21% |

| 23 | PL – Poland | 23% |

| 24 | PT – Portugal | 23% |

| 25 | RO – Romania | 19% |

| 26 | SE – Sweden | 25% |

| 27 | SI – Slovenia | 22% |

| 28 | SK – Slovakia | 20% |

Accessible through:

- WooCommerce > Settings > Booster > Emails & Misc. > EU VAT Number

Tested on ![]() WooCommerce 4.0.0 and

WooCommerce 4.0.0 and ![]() WordPress 5.3.2Plugin can be downloaded here. If there are any locked fields in the module, you will need to get Booster Plus to unlock them.

WordPress 5.3.2Plugin can be downloaded here. If there are any locked fields in the module, you will need to get Booster Plus to unlock them.

#comment>

#comment>